By: Lucio Gopar.

Images: Omar Maya Calvo.

Donations in Kind.

In-kind donations are those in which instead of donating money, the benefactor makes a contribution of goods. Some common examples of this type of donation are food, equipment, medicine, furniture, clothing, among others.

The importance of Donations in Kind.

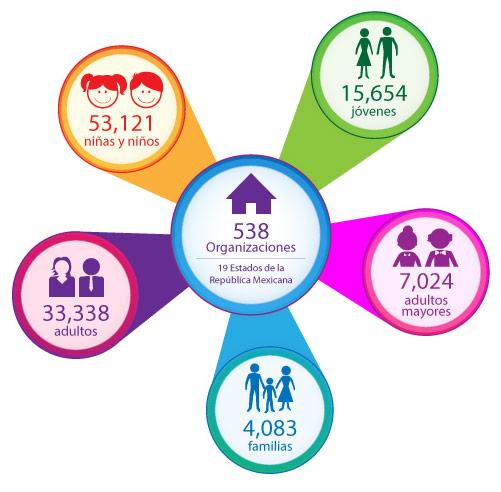

In-kind donations represent great support for all Civil Society Organizations, as they are a means of helping families, people, sectors and vulnerable groups with which they work.

In-kind donations are an important pillar for many of the projects that are carried out through civil society organizations and several of these provide their potential donors and/or volunteers with a list of needs.

In-kind donations can be food, groceries, personal hygiene items, cleaning products, medicines, milk and baby clothes, diapers, among many other products.

Civil Society Organizations.

It is important that Civil Society Organizations keep their database organized and updated, as well as their map of donors and calls. This instrument is a priority so that organizations know not only the sources of financing for their donation programs and projects, but also, to know in detail the times, characteristics and requirements of each of these national and international public calls.

Advantages of donating in kind to a Civil Society Organization

Sometimes a small contribution that costs nothing can improve someone else's situation.

It helps foundations carry out programs to benefit the most vulnerable people in society.

Significant changes are generated in others. Making a donation can improve the quality of life for many.

Helps to create a responsible and supportive Organization, improving the corporate image.

Allows you to free up storage space and dedicate it to more productive activities.

Tax incentives for socially responsible companies.

The interaction of Civil Society with the Private Sector and the alliances that can be established between them, have the potential to significantly improve the living conditions of the most vulnerable sectors of the Society.

Some civil associations or foundations look for companies committed to their society and their country, designing corporate social responsibility programs for them, harmonized with the company's values; integrated by training programs, development of altruistic activities with the staff and their families, implementation of advertising campaigns with a cause, among other actions.

The most important benefits of being a Socially Responsible Company.

Fiscal Incentives. For donations in kind or cash, a tax-deductible receipt can be issued.

Brand Building. It's a great way to build your brand, also creating a positive name around you.

Competitive Advantage: Emotional, social and human value generates empathy with customers.

New Market: Depending on the cause you support, you open up to a new segment of the population.

Civil Associations require this type of information to know what decisions they can make, to improve their Assets, says Master Felipe Valdivieso Vega, so that with this they can function with better efficiency and have much better results in their corporate purpose. , which is its raison d'être.